Understanding Audit Requirements in the UK

The basics

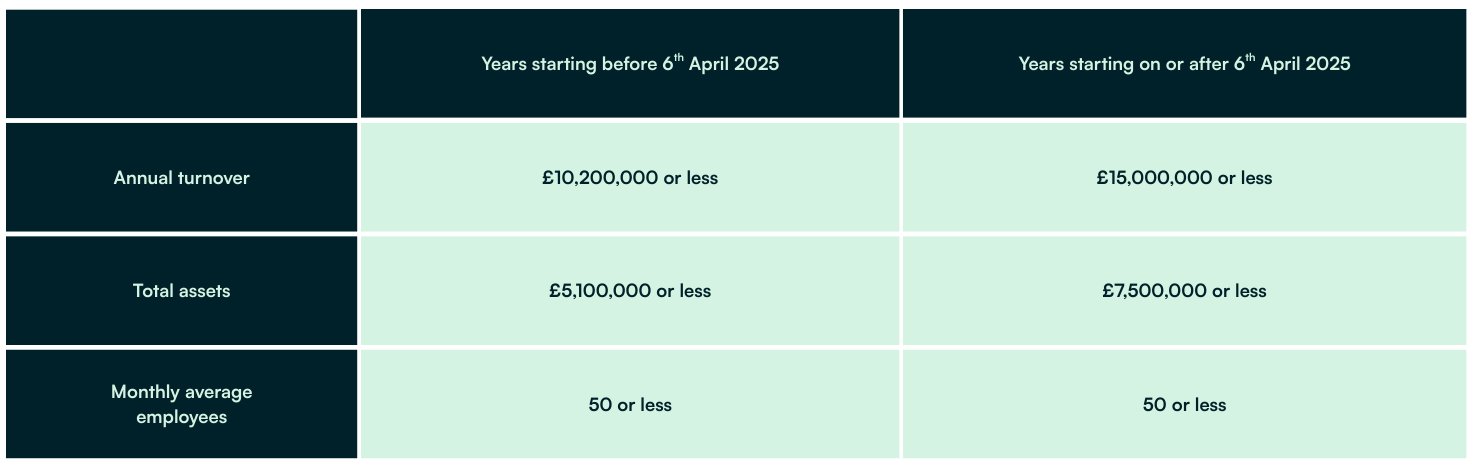

In the UK, whether a company or Limited Liability Partnership (LLP) is required to have a statutory audit largely depends on its size. Under the Companies Act 2006, most private companies are exempt from audit if they meet at least two of the following criteria:

These thresholds aim to reduce the regulatory burden on small companies & LLPs. However, even where a company meets the exemption criteria, shareholders holding at least 10% of shares may still demand an audit.

What about groups?

When it comes to groups of companies, the audit exemption rules extend beyond individual entities. A UK subsidiary may claim exemption from audit if the entire group it belongs to is small, using the same size thresholds applied on a consolidated basis. A slightly higher limit is applicable when considering figures on an aggregate basis, but for most situations, the figures above will be the most relevant.

This assessment must consider both UK and overseas entities where relevant, and a group qualifies as small only if it meets at least two of the three size criteria across the group as a whole. It’s important for directors to assess group composition carefully, as a single large entity within the group can render the exemption invalid for all subsidiaries and other group members in the UK.

Don’t forget specialised entities

Despite these general provisions, certain entities are excluded from audit exemption due to the nature of their business. Companies operating in regulated sectors – such as insurance, banking, and investment – must undergo statutory audits regardless of their size. This reflects the heightened need for public confidence and regulatory oversight in industries managing client funds or systemic financial risks. Charities, academies, solicitors and FCA regulated entities also have their own set of rules.

Not a specialised entity but part of a UK group? There may be a way out

An additional avenue for audit exemption in the UK is available under Section 479A of the Companies Act 2006, often referred to as the S479 exemption. This allows qualifying subsidiary companies to claim exemption from audit if their parent company provides a legally binding guarantee of their liabilities. To utilise this exemption, the parent must be incorporated in the UK, file consolidated accounts which include the subsidiary, and the guarantee must be filed at Companies House along with the subsidiary’s accounts.

This guarantee comes with a note of caution however. It is generally accepted that a S479 guarantee includes any off balance sheet liabilities, such as lease commitments, which could inadvertently result in the creation of a guarantor relationship, which restricts the ability of a group to ringfence or protect its assets from a default or liquidation within one of its subsidiaries. In addition to this, the group auditor will likely need to undertake work on the subsidiary liabilities and the ability of the wider group to support the company, increasing compliance costs.

Anything else?

There is a two year transition rule, special rules for custom trading periods and provisions for new entities just to name a few.

It’s all a bit complicated…

Yes – but at Affinia we specialise in helping clients navigate the complexities of UK audit requirements by breaking down the rules into clear, straightforward language. Whether you’re unsure if your company or group qualifies for an exemption, or need help understanding how industry-specific rules might apply, we’re here to provide practical, tailored advice.

Our team takes the time to explain your obligations in plain English, so you can make informed decisions with confidence – without getting lost in legal jargon. For help and assistance, contact Oliver White, one of our audit directors.