As the end of the tax year approaches, it’s time to review your personal financial affairs to ensure reliefs are maximised and planning opportunities are considered.

Year End Tax Planning for Private Clients (2024/25)

Income Tax Planning

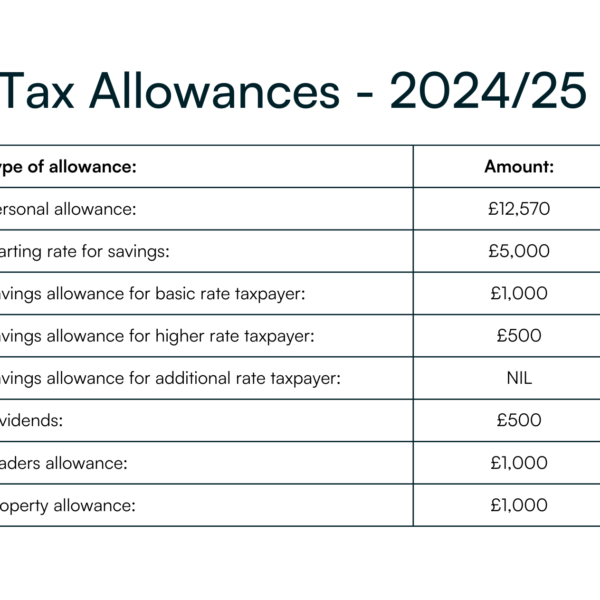

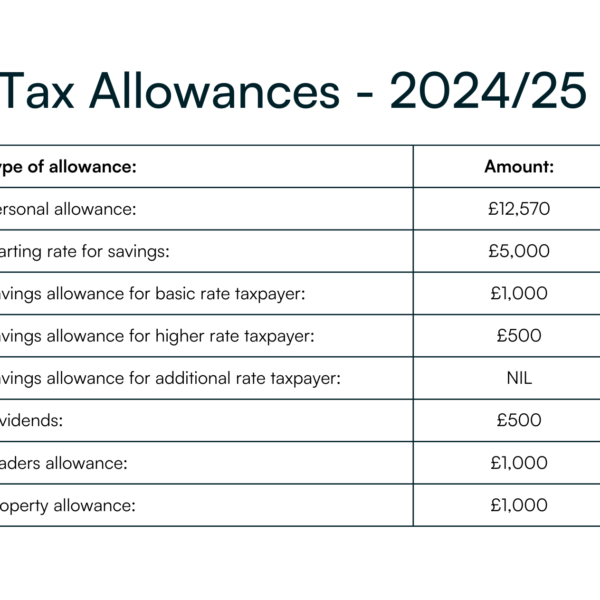

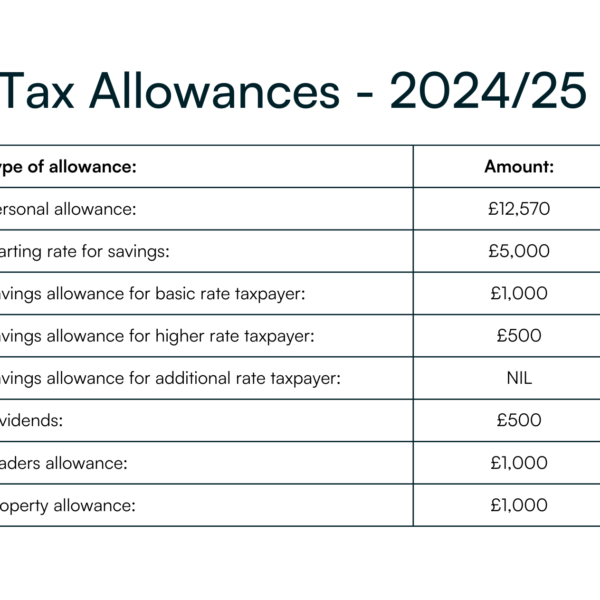

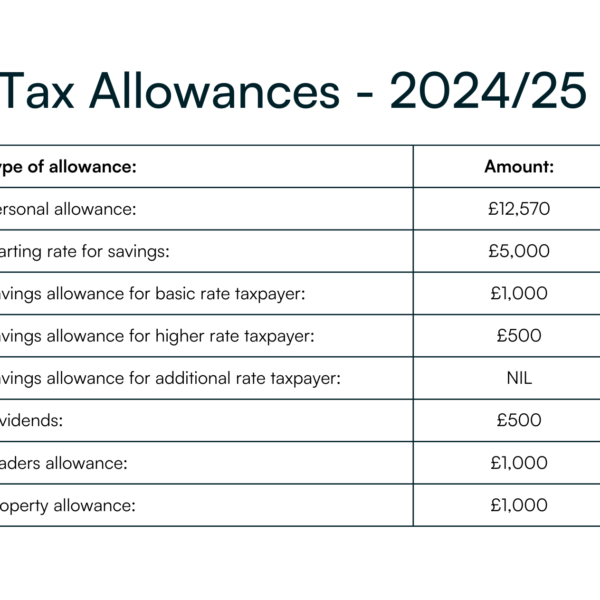

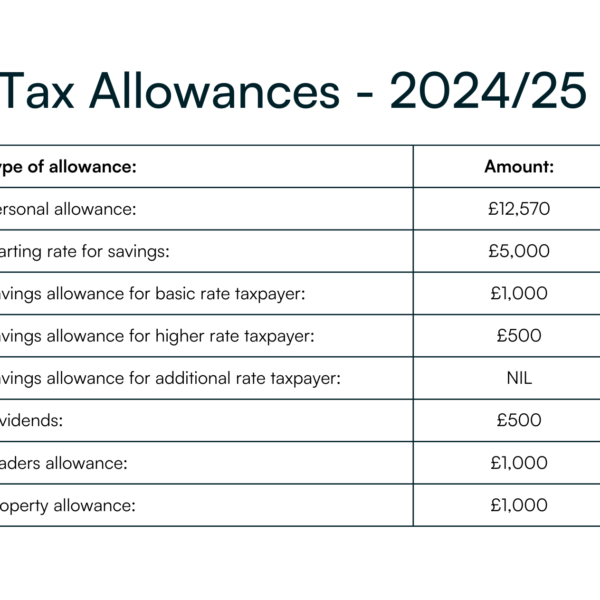

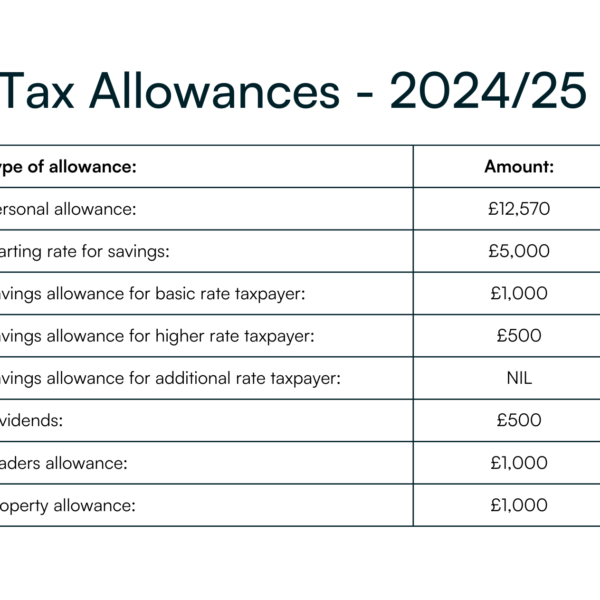

Every tax year each individual has one set of allowances available to them and if they are not used, these are effectively wasted. Likewise, if income exceeds a certain limit then some of these allowances may be reduced or lost altogether.

The highest rate of income tax that applies to total income over £125,140 is 45% and factoring in NIC this increases to 47%. For those individuals who have income between £100,001 and £125,140 incur an effective rate of income tax of 60% and with NIC this increases to 62%.

Income tax planning has never been more important to ensure that you are maximising reliefs and making the use of your allowances.

Review your Income

Review your income to ensure that you are utilising your personal allowance and lower rate bands. Married couples or those in civil partnerships have flexibility to transfer income generating assets without CGT charges to equalise income and utilise allowances and income tax bands, which in turn reduces liabilities.

Jointly Held Assets

Where assets are jointly held between spouses, any income generated is treated as being split 50:50. A declaration of trust to split the beneficial interest in the income, supported by Form 17 to HMRC, can maximise tax efficiencies between couples.

Marriage Allowance

Marriage allowance is a mechanism whereby one spouse hasn’t fully utilised their personal allowance and the other has income within the basic rate band. Subject to being eligible, it’s possible for one spouse to transfer 10% of the personal allowance.

Pension Contributions

Make Pension Contributions before the tax year end to obtain tax relief at your highest marginal rate.

Most individuals can contribute up to £60k into their pension without an income tax charge. It’s possible to look back to the three prior tax years (so to 2021/2022 onwards) for any unused pension allowances to bolster the contribution in this current tax year. Any allowance available from 2021/2022 not used in this year will be lost after 5 April 2025.

Pension contributions made by those earning £100k or over, provides an opportunity to reinstate personal allowances.

Those earning over £60k who claim child benefit also have an opportunity to make a pension contribution in order to preserve their entitlement.

Gift Aid

Gift Aid contributions provides benefit not only to the charity but also provides higher rate of additional rate tax relief. Gift aid also assists with entitlement to child benefit and reinstatement of personal allowances. A 45% tax payer who contributes £80 to charity will receive £25 tax relief and the charity can reclaim £20. Gift aid donations can also be treated as made in 2023/2024 if paid in this current tax year.

Exchanging Salary

Exchanging salary for benefits can have tax advantages. It involves exchanging part of your salary (commonly called salary-sacrifice) for certain benefits. Some common examples include sacrificing pay for additional holidays, pension contributions, cycle to work scheme and child care vouchers.

For instance contributing into a pension via salary sacrifice saves income tax and NIC. Higher rate and additional rate tax payers obtain the tax relief immediately and do not need to reclaim the relief through their self assessment tax return, which can delay the relief by several months. There is also the added benefit of saving NI.

Investments

EIS, SEIS and Venture Capital Trusts

Enterprise Investment Schemes (EIS), Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts provide income tax benefits for those individuals that invest in qualifying companies. EIS and VCTs provide 30% income tax relief, whereas SEIS investments attract 50% income tax relief, subject to certain subscription limits. In some instances, relief can be carried back to maximise reliefs across tax years and obtain relief earlier.

It’s also possible to defer or get exemption for CGT using EIS and SEIS respectively.

Exchanging Taxable Income

If you have a large portfolio of investments, consider the arrangement of the portfolio so you take advantage of tax-free wrappers and swap income generating investments for those that focus on capital growth:

- ISA allowances are maximised

- EIS, SEIS, VCTs for tax free income and CGT

- Investing in equities that produce a capital return rather than dividends

- Investment Bonds

Take advice prior to any restructuring as any changes in your portfolio could create capital gains tax issues.

Boosting State Pension

Act now before 5th April 2025

Individuals can fill the gaps in their contribution history by making voluntary National Insurance contributions – normally the deadline for doing so is 6 years.

However the 6 year limit was extended and there is a limited opportunity up to 5 April 2025 to make voluntary contributions covering the period from 6 April 2006 to 5 April 2019.

It is recommended that you undertake the following:

- Check your NI record using your HMRC online account

- Calculate whether making a payment will increase your state pension

- Make payment where appropriate prior to 5th April 2025.Complexities can occur, for example where you have contracted out previously, so take advice if you are unsure.

Capital Gains Tax Planning

For disposals after 30 October 2024 CGT rates increased from 10% to 18% for basic rate tax payers and from 20% to 24% for higher and additional rate taxpayers.

For residential property, CGT rates remain at 18% and 24% throughout 2024/2025.

Any gains realised in 2024/2025 below £3,000 are exempt from CGT.

Business Asset Disposal Relief (BADR)

BADR is available on certain business disposals by charging a lower rate of CGT on the first £1m of gains.

For those looking to exit a business, BADR rises from 10% to 14% for disposals made on or after 6 April 2025 and will increase to 18% with effect from 6 April 2026. There is a small window of opportunity to claim BADR at these lower rates.

Main Residence and Multiple Homes

If you have two or more homes, consider making a main residence election for your second home if it’s standing at a larger gain and you have plans to sell this first. Note that quality of occupation is key when reviewing the position and advice is crucial in this area of taxation.

Residency and Domicile

2024/2025 is a key year for non-UK Domiciliaries or for those planning to leave or come to the UK. If you haven’t already done so, you need to review your position prior to 5 April 2025.

With the rules around residency and domicile being so complex with many varying personal factors it’s key to seek specialist advise before any action is taken. but some key points to consider:

Read more from the full guide:

Our Services

Accountancy & Advisory

Our accountancy & business advisory services are tailored to your company’s needs. We give your business actionable insights and practical advice to elevate your company, and help you reach the next level.

Digital Solutions

Adopting cloud-based solutions for accounting, stock control, collaboration, HR, and marketing can automate work, enhance efficiency, and save costs for businesses integrating technology.

Audit Services

We can adapt to meet all your auditing needs, from statutory to interim and heavily bespoke audits. We aim to remove this pressure with minimum disruption to your everyday business.

Tax & Planning

Our tax planning services help minimise tax liabilities while ensuring compliance with laws and regulations. We assist with basic tax compliance to complex issues like Group Restructuring.

Corporate Finance

Whether you require support for an MBO, business valuation or are looking to exit your business, our team combine significant accounting, banking and taxation expertise to support you through the process.

Payroll

We deliver the feel of a personal in-house payroll function in an accessible and down-to-earth way.

Our services help employers improve efficiency, accuracy and performance, allowing you to focus on making the right business decisions for your company.